Every One Knows the importance of life insurance policy. You require external ability to help you fiscally whenever you might want it. Obviously, nobody is unaware of the factor; as a result, you’ll want run into several insurance agencies attempting to market their insurance coverage policies. As there are many alternatives available in this fiscal location, how do you really know that which is your best? Effectively, for that, you desire a Compare Life Insurance technique.

What is the system?

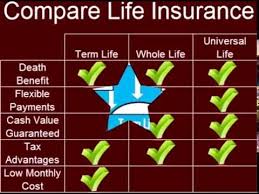

Effectively, Via this system, you’re able to assess all types of life insurance policies that you may have run into. Following that, it is possible to review the benefits, disadvantages, and also the benefits of the exact same. Along with thatyou can evaluate the values and the principal value which you could need to pay out. This wayyou get yourself a relative graph concluding the best coverages to get for youpersonally.

In which can you get the contrast?

In case You want a Life Insurance Comparison, then a optimal/optimally option you have will be always to stop by the online portals. On these portals, you receive the option to create your profile and state your own requirements. Then, the web site can draw a graph of all the feasible policies you may study. This way, you may pick an ideal plan and cover to the same accordingly.

When You’ve got several options in the hand, you’ve got the find one which gives you the maximum at least cost. So, just why wait around? Catch your option today.