There Are numerous aspects to take into consideration when completing the paper work associated with your retirement. It could possibly be that a few options continue to be not known to you which can supply you with benefits.

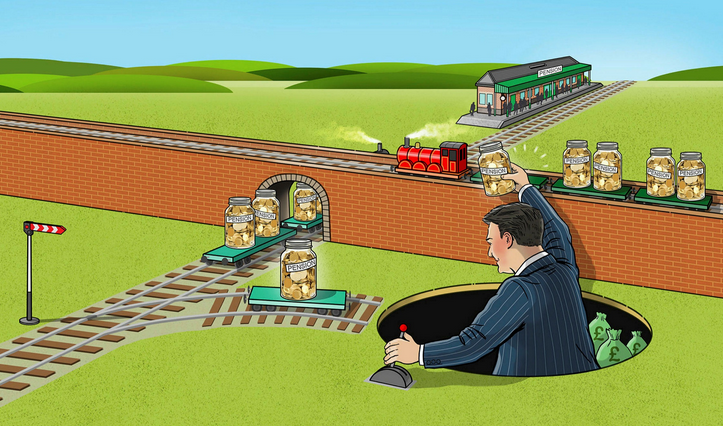

There Are individuals who would like to understand everything related to final salary pensions, even the single means to understand if that represents a benefit to you personally is by simply selecting Final salary pension advisors.

These Folks are qualified and also so are specialists to supply all the necessary info, examine your particular situation and also consider the possibilities of danger.

Every Day more folks want to produce informed decisions and also select in the retirement programs available to guarantee their fiscal future, especially when they’ve finished their working life.

Today You can do it in the best manner, in the event that you get the appropriate pension help, you only have to book your very first consultation free of charge and thus these specialists might provide a review of the choices available to you.

If You’ve previously thought of some thing , you simply need to share with you your aims, and if to the contrary you still do not know what to do and so are thinking about moving the last wages for your own beneficiaries, you merely have to be conscious of the risk-benefit ratio associated with this action.

Juniper Pensions experts only urge and handle what exactly is ideal for you personally, entirely analyzing existing retirement schemes to guide you determined by probably the most suitable choice.

All The information you need to understand concerning your possible final income pension program, you only need to reserve a scheduled appointment at Juniper Pensions, the best pension advice company.

Learn Every depth of the way in which your final salary retirement is calculated and begin your own aims based in your source of income. It is very vital that you are aware of the great things about the end investment strategies.

That which May depend on time you’re causing your plan, nearly all of the schemes coincide with the retirement age, unless you request a earlier retirement, that is possible right after 55 years, you are able to only obtain a proportion of one’s salary, losing the solution to get it complete.